do you pay california state taxes if you live in nevada

A 1 mental health services tax applies to income exceeding 1 million. This adds a significant toll to purchases.

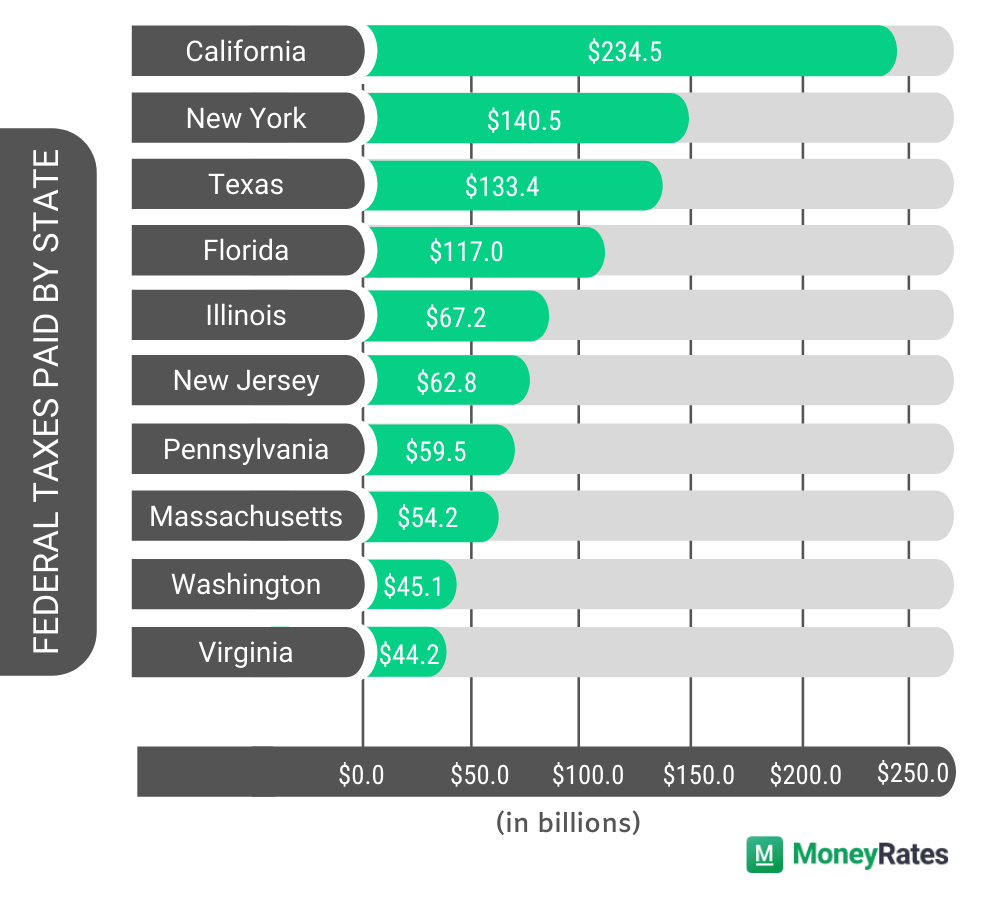

Which States Pay The Most Federal Taxes Moneyrates

Click to see full answer Moreover do I have to pay California income tax if I live out of state.

. Local sales taxes increase this total with the largest total rates hitting 105. Residents of Iowa Kentucky Michigan and Wisconsin are exempt. It is true that in Nevada you do not pay tax on that income but California can tax you.

If taxes have been withheld you may be due a refund if. PROPERTY TAXES Property taxes in California are in the range of 11 to 16 of the assessed land value. If you hold residency in California but serve in the military in Nevada under a Permanent Change of Station Order you usually dont have to pay California income taxes.

If Florida had state income tax you could take a credit for the tax you paid there but they dont. California can now push even on sole proprietors who might have California customers. My experience has shown me that if it is Primary than the tax advantages can be more substantial.

All worldwide income received while a California resident. If you maintain a part-time residence in California and live part of the year in another state you may have to pay taxes on your pension in both states. You will have to pay California tax on your distributive share of the companys LLC income despite the LLC having earned all of its income outside of California say another state like Nevada.

If you owe use tax it will be based on the purchase price of the car minus the sales tax you paid to another state. Here is a California Tax Board website that provides more information. All worldwide income received while a California residentIncome from California sources while you were a nonresident.

If you lived inside or outside of California during the tax year you may be a part-year resident. They might have to. If you dont live in DC you dont have to pay income tax for the district.

Residents of California Indiana Oregon and Virginia are exempt from paying income tax on wages earned in Arizona. Income from California sources while you were a nonresident. Generally if you work in California whether youre a resident or not you have to pay income taxes on the wages you earn for those services.

Just now. Your resident state taxes you on all worldwide income just like Federal. All worldwide income received while a California residentIncome from California sources while you were a nonresident.

Yes it sure seems that way. As a resident we have no state income tax if you earn your money in Nevada or if you have passive income even if it comes from California. As a California resident you would pay California income tax on your income and that includes income earned out of the state.

If you earn income from other sources the FTB may require you to pay state income taxes on those earnings. Residents of Kentucky Michigan Ohio. If you lived inside or outside of California during the tax year you may be a part-year resident.

At the end of the tax year you will file a California nonresident tax return. This is true even if you are a nonresident even if the employment agreement with the employer is made out-of-state and even if the wages are paid to you outside of California. For example if you live in California for.

When you work in one state and live in another income taxes can become confusing. As a part-year resident you pay tax on. If you work for a California company chances are you will pay California taxes despite the fact that you live in a no-tax state like Nevada.

As a part-year resident you pay tax on. Hi Even though you live in Nevada which has no state income tax any income you earn in the state of California is taxable to California as California source income. The employer should be withholding California state income taxes from your wages.

Nevada property taxes one of the lowest in the nation average 077 of the assessed land value. Generally if you work in California whether youre a resident or not you have to pay income taxes on the wages you earn for those services. As a part-year resident you pay tax on.

You can pay the tax when you register the vehicle or you can file a claim with the California. Similarly you may ask do I have to pay California income tax if I live out of state. Yes unless you purchased and used your car outside California for at least 12 months before you brought it into the state.

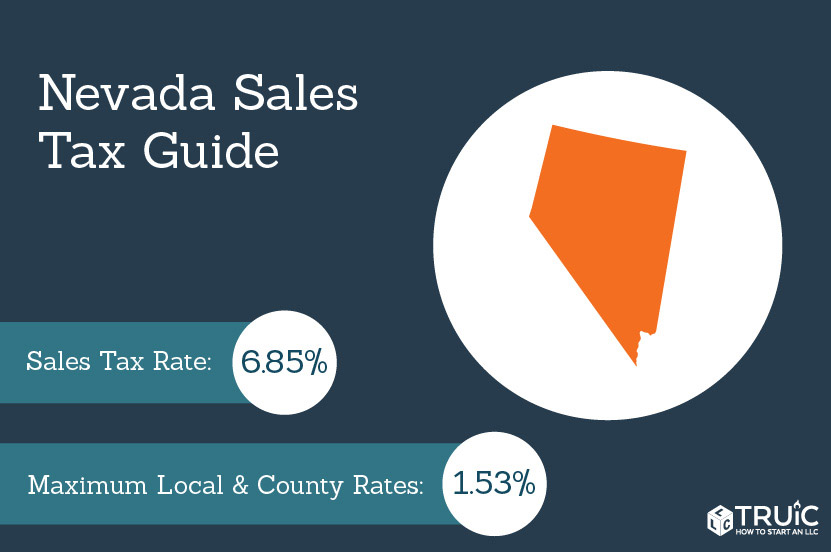

Consumers in California are hit with a sales tax of 725. Nevadas sales tax is much smaller by comparison. The minimum wage in California ranges from 1050 to 1100 per hour.

The minimum wage in Nevada is 725. If you are a resident of Nevada and are employed in California you will be taxed by California. The second rule is that California will tax income generated in the state regardless of where you live.

This applies only to military wages you earn while serving in Nevada however. Thats due to the source rule. California state tax rates are 1 2 4 6 8 93 103 113 and 123.

Many people have tried to say they lived in Nevada and worked there remotely for. In California the bottom 20 percent of income earners those earning less than 23200 pay 105 percent in state and local taxes while the top 1 percent those earning 714400 or more. Click to see full answer Also question is do I have to pay California income tax if I live out of state.

California taxes all taxable income with a source in California regardless of the taxpayers residency. You will have to prove that you are not a California resident and prove that you didnt put one toe into California for any reason. The state sales tax in Nevada is 46 which is 265 lower than its neighbor to the west.

If you lived inside or outside of California during the tax year you may be a part-year resident. Yea they are that aggressive. Although you must typically pay income tax to your state of residence even if you earn your income outside the.

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

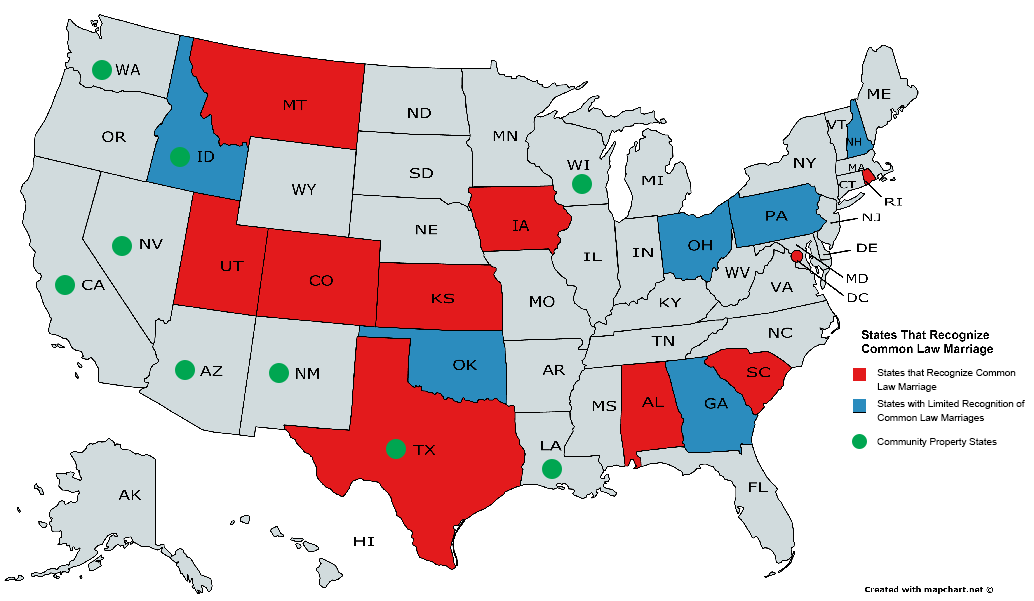

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

How High Are Capital Gains Taxes In Your State Tax Foundation

Nevada Sales Tax Small Business Guide Truic

Top 4 Reasons Why You Should Buy Anthem Las Vegas Homes For Sale Las Vegas Homes Las Vegas Las Vegas Free

States With No Income Tax H R Block

Today S Mortgage Closing Costs Listed For All 50 States

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Retirement Income Retirement Locations

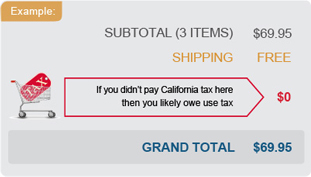

California Use Tax Information

State Taxation As It Applies To 1031 Exchanges

Get The Best Tax Service Tax Refund Tax Services Tax Preparation

What Is Local Income Tax Types States With Local Income Tax More

State Taxation As It Applies To 1031 Exchanges

How Far Will Dollar Stretch Real Value Of 100 In Each State Revealed Map Usa Map States

Tax Hacks From Sprintax How To File Nonresident Tax Returns For Multiple Us States

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

Monday Map State Income Taxes On Social Security Benefits Social Security Benefits Map Social Security

Does Your State Have An Individual Alternative Minimum Tax Amt

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)